COI: Procedures and Guidance

Filing a COI disclosure is a crucial step in complying with federal, state, and university COI regulations and ensuring that individuals and the university avoid penalties for COI non-compliance. The university relies on you to file your annual COI disclosure and keep it up to date so that it continues to meet its institutional obligations to the UNC System and the agencies that fund university research.

- Who is required to complete an annual COI disclosure?

- When do I need to complete my COI disclosure?

- What types of Financial Interest must be disclosed?

- What happens when I have a conflict that requires management?

- What are the COI requirements for those completing human subjects research?

- What federal sponsors have specific COI rules?

- How will I know if my COI disclosure has been successfully submitted?

- What happens once my COI disclosure is submitted?

Who is required to complete an annual COI disclosure?

- All faculty (including adjunct faculty; and emeritus faculty who are participating in a sponsored project)

- Postdoctoral scholars

- EHRA professionals paid from any source

- Graduate assistants (GAs) paid from ledger 5 (sponsored research) funds

- SHRA employees paid from ledger 5 (sponsored research) funds

- Research personnel engaged in the design, conduct, or reporting of sponsored research (including part-time and temporary employees)

When should a COI Disclosure be Submitted or Updated?

Employees who fall into one of the categories listed above are required to file a COI disclosure with NC State once every 365 days in order to adhere to university 01.25.01- Regulation Conflicts of Interest and Commitment.

If your circumstances change after you’ve filed your annual COI disclosure, you must file a revised disclosure within 30 days of the change to notify the university accordingly.

What types of Financial Interest must be disclosed?

All financial interests and those of the individual’s spouse and dependent children that appear to be related to a covered individual’s university employment responsibilities must be reported, regardless of value.

The following are examples of what is (and is not) considered reportable Financial Interest:

| Forms of Financial Interest | REQUIRED to be disclosed (IF related to one’s university employment duties) | NOT required to be disclosed |

|---|---|---|

| Compensation | Any remuneration, regardless of value, including but not limited to : Employment (other than NC State) Consulting activities Service on an advisory board or board of directors Product evaluation payments Legal consulting activities (such as expert witness testimony) Service to a non-profit organization (such as service on a board or consulting) Publishing agreements, Royalties for books, or Authorship Honoraria or other compensation for activities such as talks or educational activities | Salary or other Remuneration paid by NC State Service on advisory committees or review panels paid by U.S. government agencies Income from seminars, lectures, or teaching engagements sponsored by:

|

| Royalties | property rights (e.g., cash royalty payments, milestone payments) received through NC State University and from other academic institutions or organizations | Royalties received through NC State University and Unlicensed Intellectual property that does not generate income |

| Equity/ Ownership Interest (from publicly-traded or privately-held entities) | Ownership Interest in an entity (Stock, Stock Options, Warrants, Vested shares, or other ownership/equity interest) | Income from investment vehicles (such as mutual funds, retirement accounts, and blind trusts) as long as the individual does not have direct control over the investment decisions |

| Sponsored or Reimbursed Travel | Travel for which the covered individual is reimbursed by an outside entity Travel that is paid for on the covered individual’s behalf by an outside entity Includes any registration fees, accommodations, transportation costs, etc. Examples of outside entities: Professional Societies Foreign institutions of higher education and funding agencies For-profit or Non-profit Entities | Travel administered through NC State University, and travel reimbursed or sponsored by the U.S. Federal, State, or local government agency, Other U.S. institutions of higher education, academic teaching hospitals, medical centers, or research institutes affiliated with an institution of higher education |

What happens when I have a conflict that requires management?

Consistent with the entrepreneurial spirit of innovation at NC State University, the institution encourages the transfer and advancement of knowledge through relationships with outside businesses, scholarly publications, and the creation and licensing of intellectual property. Nonetheless, the university must also adhere to federal, state, and sponsor regulations regarding conflicts of interest while safeguarding public trust in the integrity and trustworthiness of our institution’s research.

This requires the establishment of a carefully controlled and monitored process of ensuring that we meet standards of objectivity that are critical to the preservation and expansion of knowledge. The management plan is a key component of this process. It is a document that outlines and implements measures to actively reduce, mitigate, or eliminate an actual, potential, or perceived conflict of interest held by an employee.

What are the COI requirements for those completing human subjects research?

If you are completing research with human subjects, you must provide your COI disclosure information to the NC State Institutional Review Board (IRB) when you are filling out your IRB application.

Please visit the NC State Human Subjects page for more information about performing research with human subjects, and check out the IRB’s standard operating procedure for addressing issues of COI in the IRB application.

How will I know if my COI disclosure has been successfully submitted?

You will receive a confirmation email from the COI office that you have successfully submitted your COI Disclosure. Please contact the COI office at COI-NOI-Compliance@ncsu.edu if you have not received a confirmation email.

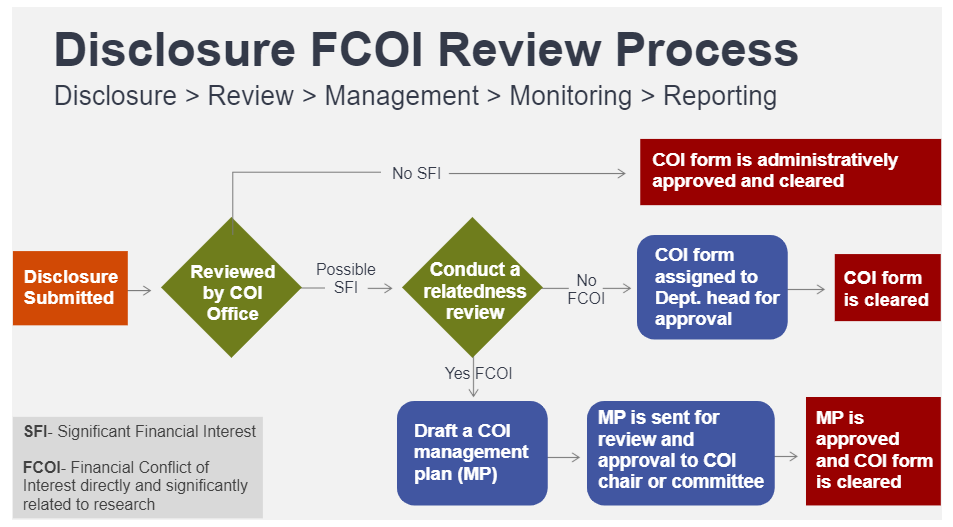

What happens once my COI disclosure is submitted?

All Submitted COI Disclosures are routed to the COI Office for an administrative review and for the COI administrator to determine whether the submitted disclosure requires further review based on the Financial Interest/Relationship disclosed. If no further review is required due to the nonexistence of a Financial Interest, then the disclosure is administratively approved and cleared.

Types of FCOI/Relatedness Review

Annually or updated COI Disclosure

Financial Interest disclosed on the updated or annually submitted COI Disclosure will be reviewed against all sponsored research to determine if an FCOI exists.

If an FCOI is identified, the COI Office, in conjunction with the Department heads/Chairs and/or other supervisors, will recommend a COI Management Plan (COI MP) to help eliminate or mitigate any perception of bias in research. The COI Committee/chair reviews approves, and monitors all COI MPs pursuant to University Regulation (REG 01.25.01)and applicable federal regulations.

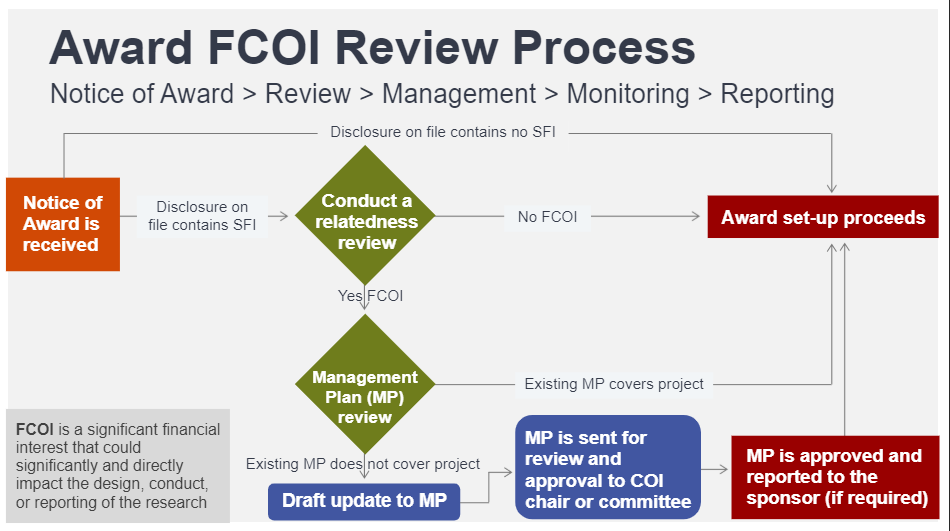

Project-based FCOI Review

The COI Office will review all Notice of Awards (new awards, to and from contracts- subawards/sub-recipients) against each investigator’s current and up-to-date COI Disclosure to determine if FCOI exists.

If an FCOI is identified, the COI Office, in conjunction with the Department heads/Chairs and/or other supervisors, will recommend a COI MP to help eliminate or mitigate any perception of bias in research. The COI Committee/chair reviews, approves and monitors all COI MPs pursuant to University Regulations and applicable federal regulations.